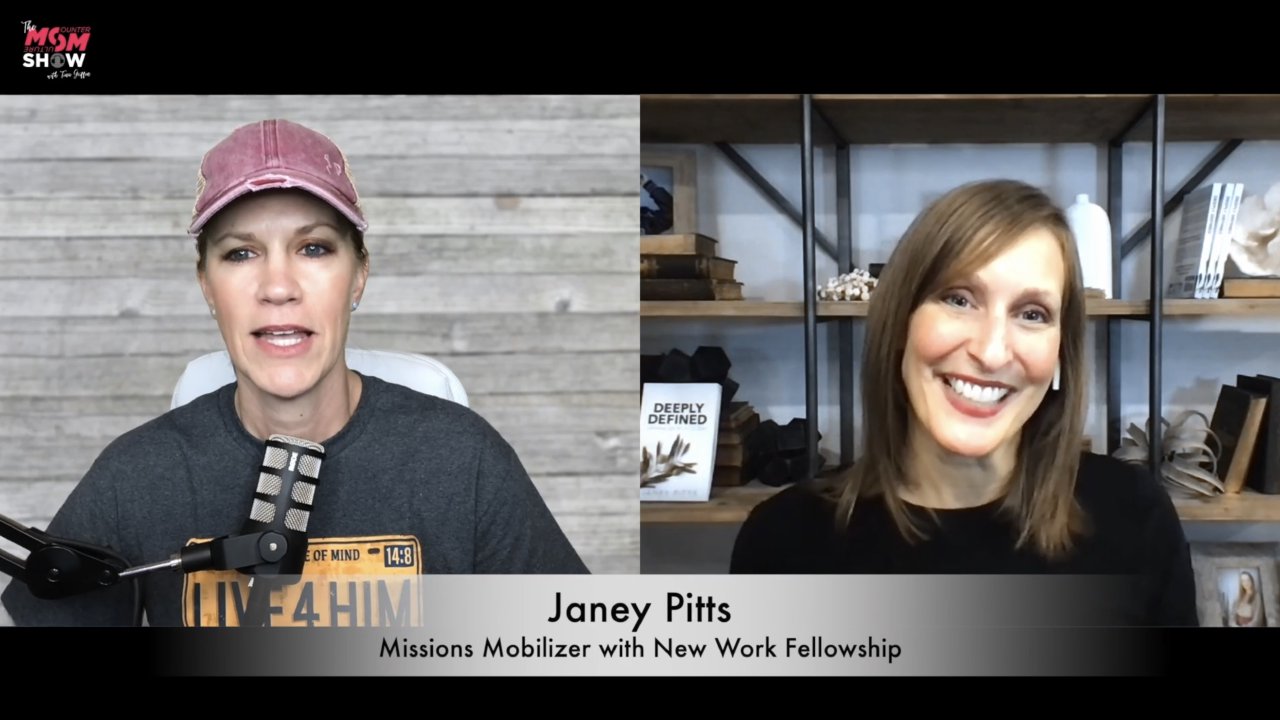

Christians use words every day with reckless abandon, failing to understand what they mean. Janey Pitts is the author of Deeply Defined: Understanding Who You Are in Christ. Janey is also the Missions Mobilizer at New Work Fellowship, and discusses the importance of properly defining words like grace and holiness. Janey explains the delicate balance between doing things for the Lord and simply resting and being still in the Lord. “It’s important sometimes to just stop and BE,” she says. We don’t have to earn the Lord’s love or salvation. However, we are still called to use our gifts to glorify God. You don’t just sit and think about what God is calling you to do - it has to be accompanied by action!

TAKEAWAYS

Kaphar is a Hebrew word that means to cover, or atone for sin

Grace is when God gives us what we don’t deserve, and mercy is when God doesn’t give us what we do deserve

Salach is a Hebrew word that means to forgive, or to pardon

Obedience means hearing God’s Word and then living it out

🛠 TOOLS AND RESOURCES FROM EPISODE

Book Promo Video: https://bit.ly/3ZyOI90

Kerusso T-shirts (get 15% off with code TINA): http://bit.ly/3SbSJvN

Free Bible Study Discussion Guides: http://bit.ly/3CLtg6I

Deeply Defined Book: https://amzn.to/3ksOSic

🔗 CONNECT WITH JANEY PITTS

Website: https://www.janeypitts.com/

Facebook: https://www.facebook.com/OfficialJaneyPitts/

Instagram: https://www.instagram.com/officialjaneypitts/

Pinterest: https://www.pinterest.com/coryjane/

🔗 CONNECT WITH COUNTER CULTURE MOM

https://linktr.ee/CounterCultureMom

📺 WATCH OUR PREVIOUS SHOWS

📲 GET OUR APP & FREE PARENT MEDIA GUIDE

💵 SUPPORT THE MISSION

2021 Recap & 2022 Goals: https://bit.ly/CCMDonate2021

Make a Tax-Deductible Donation: https://counterculturemom.com/partner/